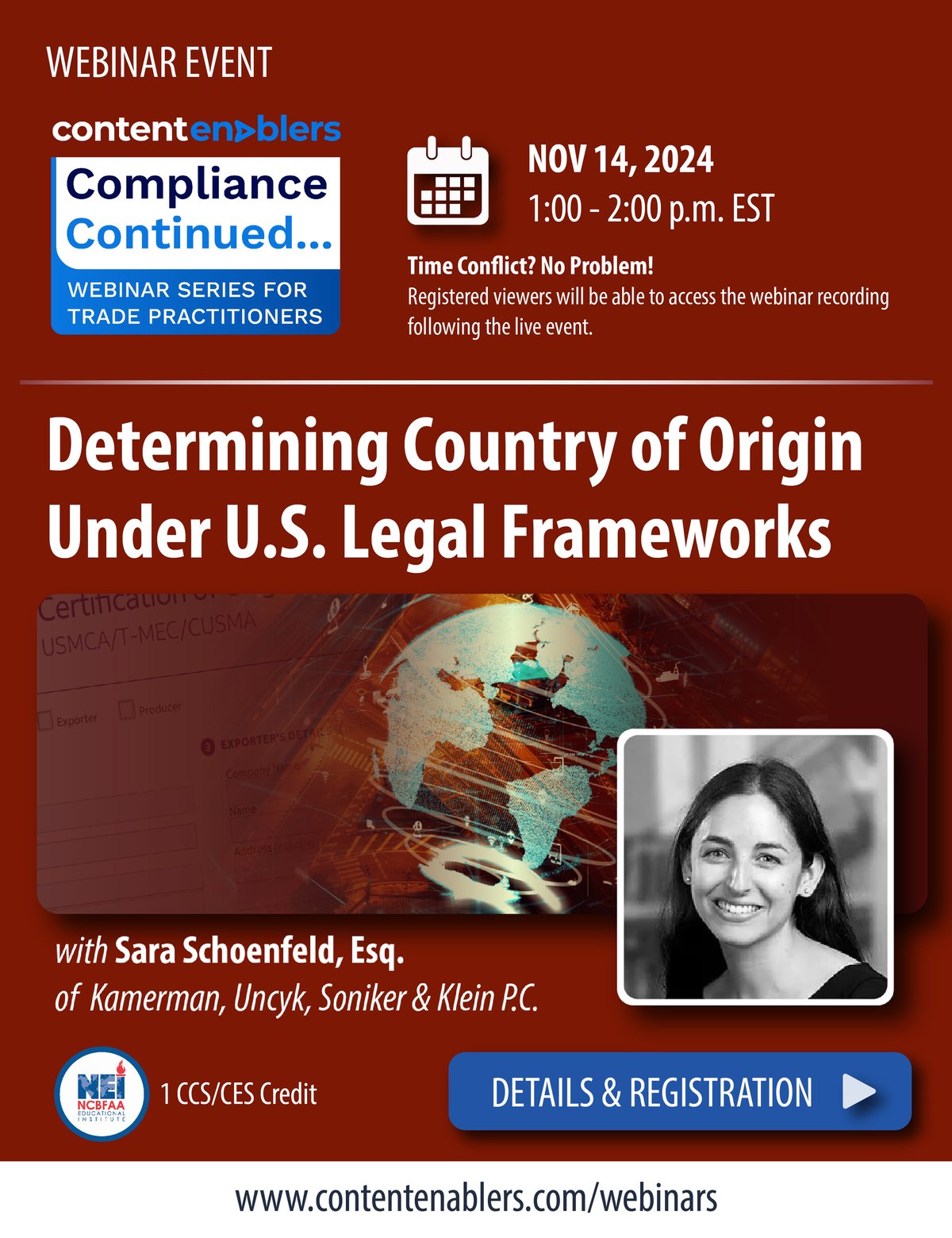

Country of origin determinations under U.S. law are complex and often confusing. The recent addition of Section 301 tariffs and forced labor legislation has further complicated these analyses. As a result, everyday sourcing and supply chain decision-making may have far-reaching compliance, reputational, and/or cost implications.

Using case studies, this webinar will illustrate how country of origin determinations are made in practice, under a variety of U.S. legal frameworks. We will consider the compliance implications as well as cost-savings opportunities that relate to country of origin determinations.

Finally, we will cover key takeaways on this topic from the November 2024 U.S. election and what we can expect next when it comes to trade remedies and tariffs.

This webinar will cover the following topics:

- Determining country of origin of a product under U.S. law

- Substantial transformation versus tariff shift

- Most-favored-nation treatment

- Country of origin marking

- Free trade agreements, spotlighting the USMCA

- Section 301 origin determinations

- Other trade remedies (antidumping duties and countervailing duties)

- Forced labor legislation

- Government procurement (“Buy American”)

- Textile and apparel rules

- Observing the rules and making sound business decisions

- Tips for complying with “reasonable care” requirements

- Duty mitigation techniques related to origin

- Tariff avoidance versus tariff evasion

- Election takeaways: What to expect next in tariffs and trade remedies

Who should attend?

- Global trade compliance professionals

- Import/export compliance personnel

- Business planners

- Tax and accounting department

- Legal department

- International purchasing and logistics managers

- Customs brokers

There will be time for questions from webinar participants.